Wealth solutions in all flavours

We offer a range of personalised wealth solutions for clients from diverse backgrounds such as entrepreneurs, company founders, CXOs, professionals such as doctors, lawyers and CAs, in addition to family offices and company treasuries.

Different strokes for different folks

Based on your profile, goals and priorities, we curate the right solution from a range of investment ideas.

We bring to the table ideas spanning multiple asset classes.

- EquityWe offer a range of equity-based investment products such as Direct Equities, Mutual Funds, Portfolio Management Services, Derivatives, Alternate Investment Funds, Structured products and Global Investments.

- Fixed IncomeYou have a choice encompassing primary and secondary market Fixed Income instruments, Mutual Funds, Debt-based Alternate Investment Funds, Tax free paper, debt-oriented and Structured Products.

- AlternativesWe provide opportunities to invest in niche private investment ideas via Private Equity and Venture Capital Funds, Unlisted Equities and Bespoke Ideas.

- InsuranceWe offer a host of insurance solutions encompassing Life and General Insurance in addition to expertise in Global Health insurance solutions.

Our open architecture approach ensures that we conduct extensive due diligence and understand each product prior to collaborating with an investment partner/manufacturer.

When you need a ‘portfolio approach’ over a ‘product-led’ engagement, then our advisory services mandate may be the perfect fit for you. Our advisory services proposition is a truly unbiased engagement platform which seeks to offer a real alignment of interest. The focus is to look beyond just a transaction, and look at our collective wealth domain expertise and infrastructure to work towards your sustained satisfaction.

Our platform capabilities are equally engineered to create solutions that put you first.

Also, given the fact that you may have multiple wealth partnerships, we offer the ability to execute transactions on a platform of your preference.

With the equity advisory platform, we bring a proactive approach to the equities space with a consultative engagement model. Attention to your unique risk tolerance, investment preference and investment horizon forms the bedrock of the proposition.

The core investment philosophy at the equity advisory desk entails a thorough evaluation of:

- Quality of the business

- Size of the opportunity

- Share of the Industry/growth

- Valuations/Margin of safety

A custom investment portfolio is built based on your unique background and nuances rather than aligning holdings to a model portfolio.

We have an exclusive desk which brings forth boutique or ‘off the conventional shelf’ ideas.

This includes:

- Unlisted/Pre-IPO opportunities

- Structured/customised debt transactions

- Venture investing (directly/jointly with funds)

- Distressed asset investments

These are just a few illustrations from a wide swathe of opportunities that we continuously scan and evaluate for you from across the investment landscape.

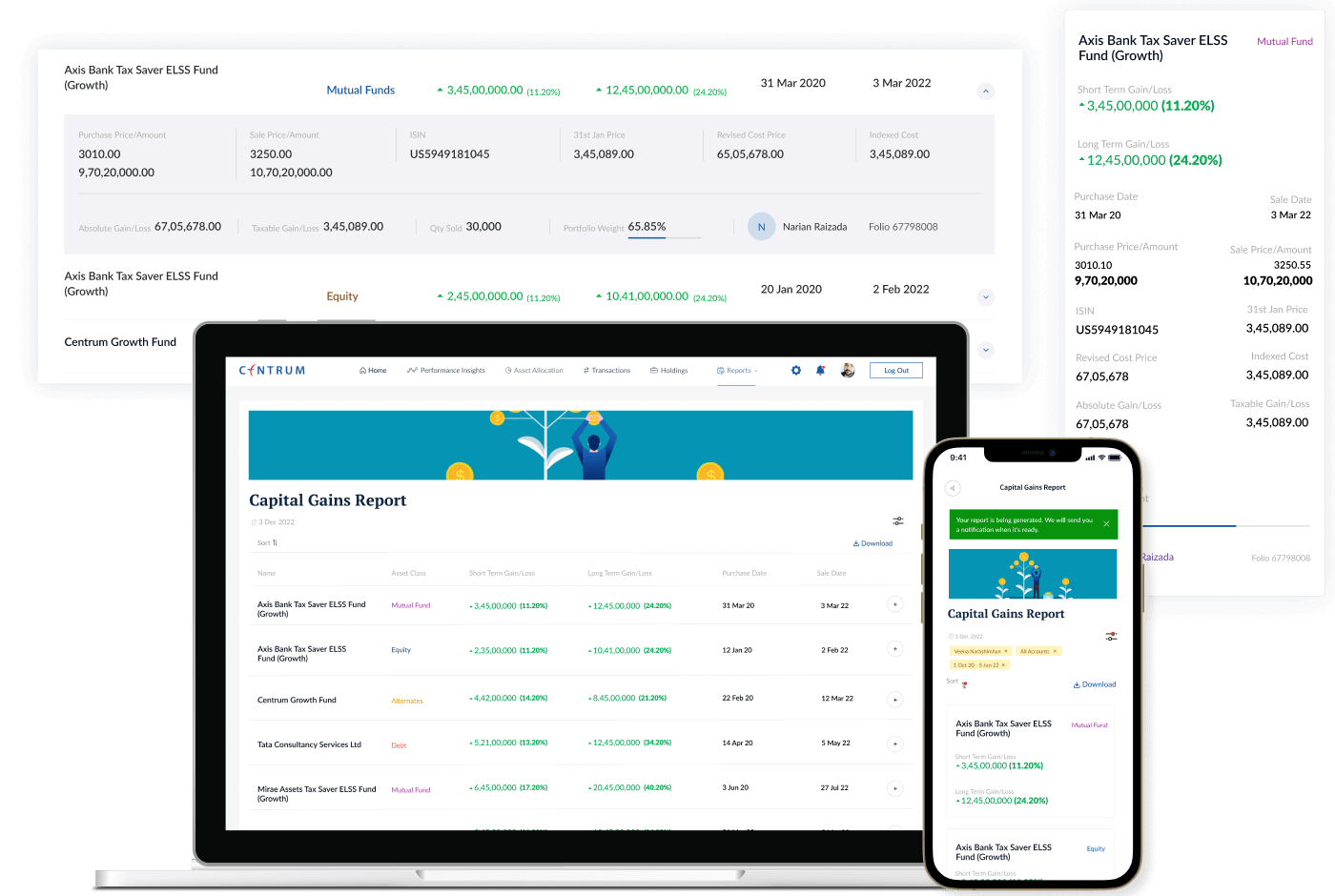

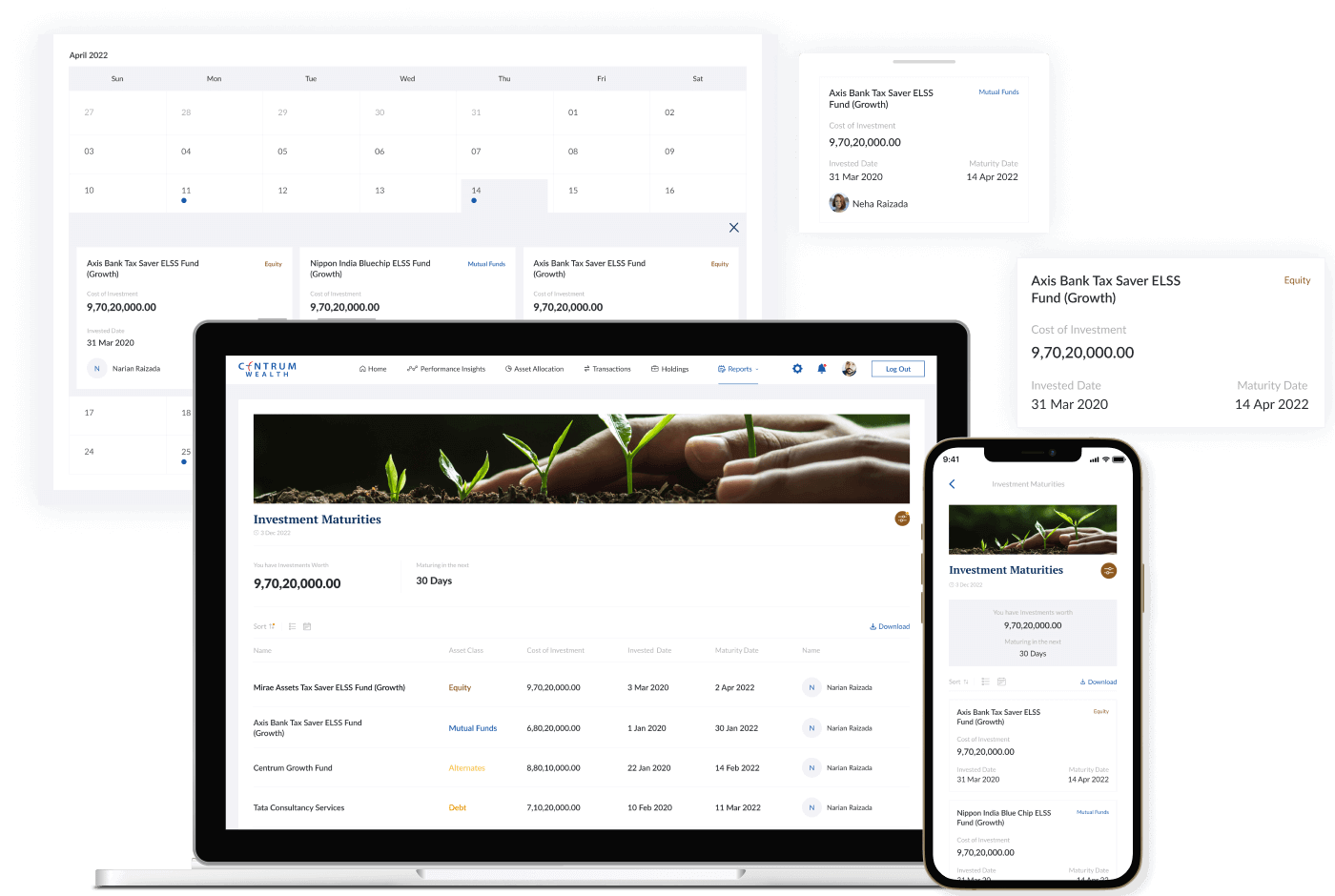

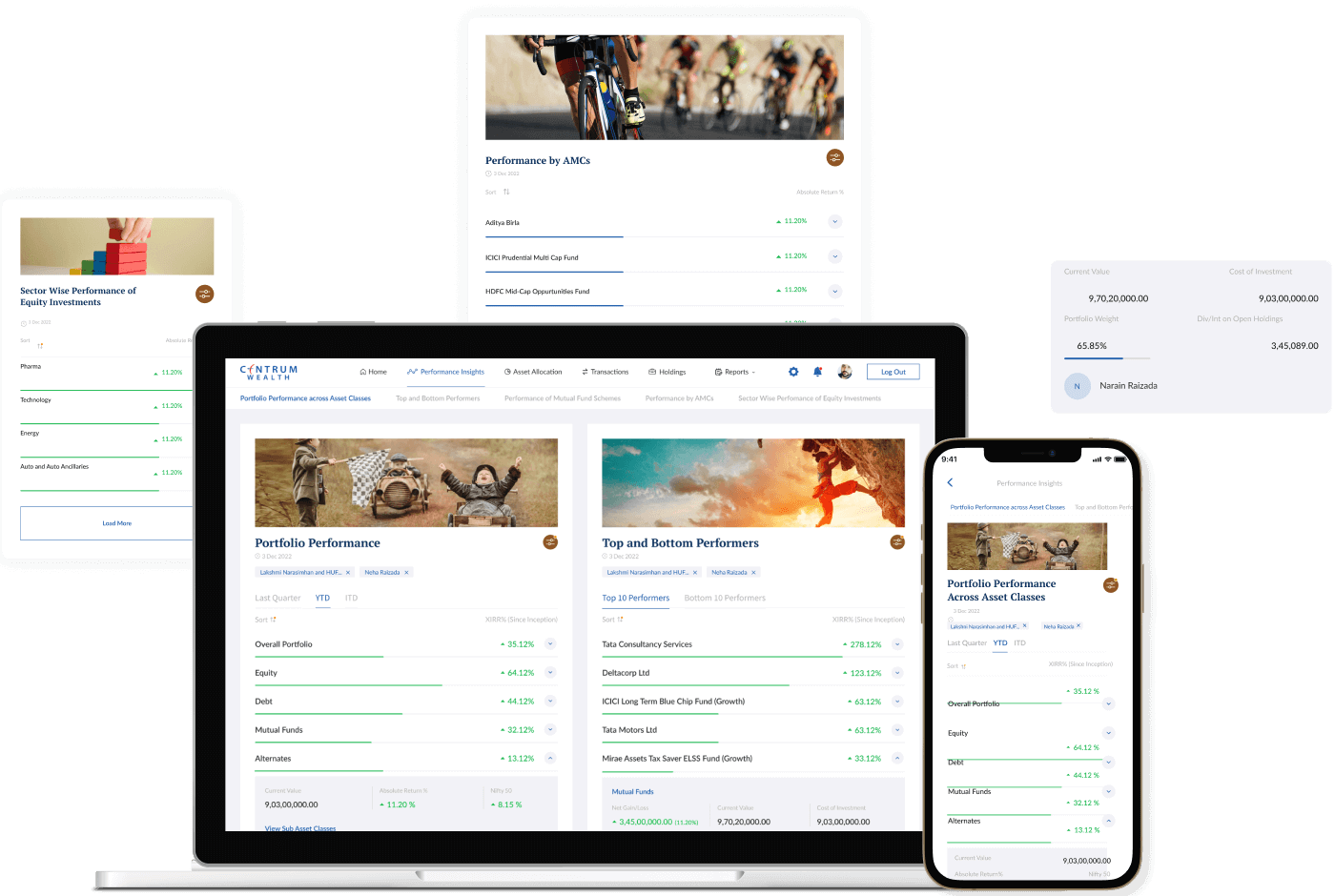

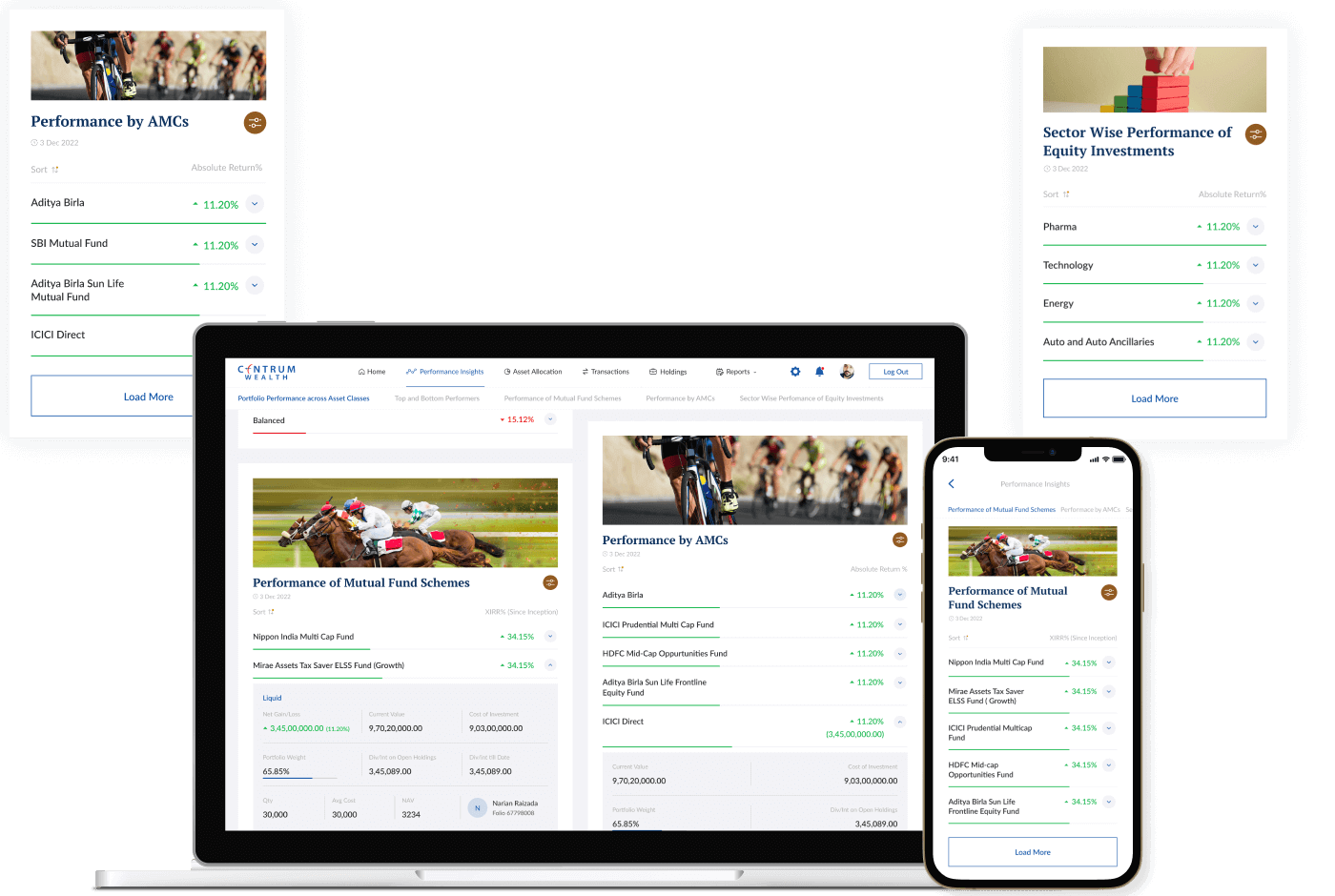

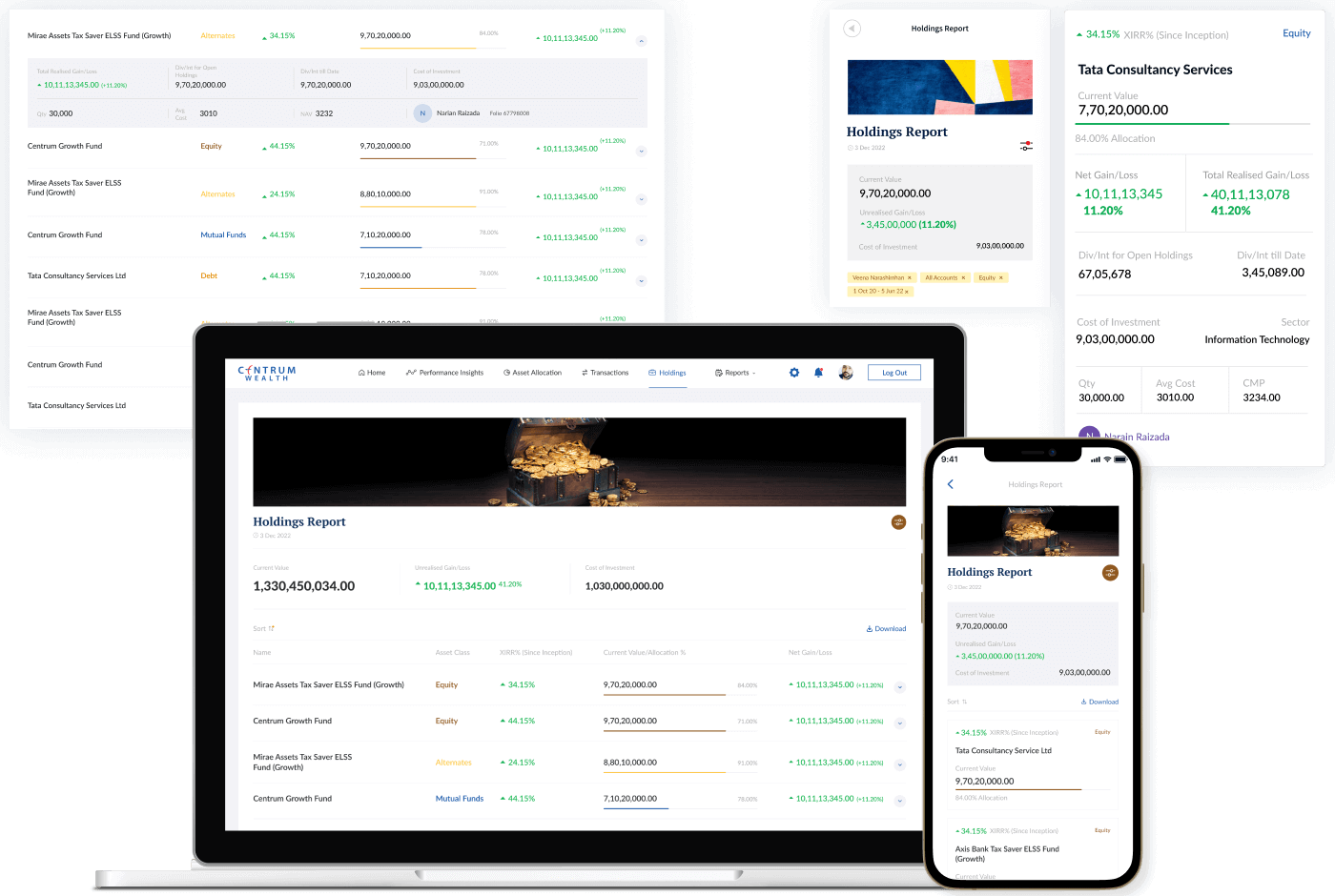

A platform for performance insights

Information overload often clouds the decision-making process. The Centrum Wealth Wealthverse platform brings you anytime access to your portfolio and enables analysing holdings in your way.

Know MoreLeadership Perspectives

-

Business

Market Insights

Manish Jain shares his perspective on market conditions, economic factors, and potential opportunities in March 2026. Gain from an informed view of what lies ahead and how to navigate market conditions to keep your investment strategies aligned.

Know More -

Business

Thinking Outside In: Part 2

Priya Kumar, Author, Motivational Speaker, and Screenwriter, reflects on the hidden mindset gaps between where organisations believe they are — and where they truly stand. We also feature a perspective that explores a deeper layer of leadership and storytelling: What she looks for beyond public achievements when writing someone’s story The common inner struggles leaders […]

Know More -

Business

Thinking Outside In: Bonus Insights

Priya Kumar, Author, Motivational Speaker, and Screenwriter, reflects on the experiences that shaped her work across 17 published books. We feature a bonus question that brings out a more personal dimension of her authorial journey: Her three most significant memories from authoring 17 books The lessons that stayed with her beyond publication. Watch Now!

Know More