Investment policy statement

The investment policy statement communicates the investment goals & serves as a guidepost for ongoing management of the portfolio. It creates the necessary guard rails so that risk limits are not busted in ‘good times’.

-

The investment horizon

-

The investment objective

-

The portfolio liquidity required

-

Asset allocation choices

-

The possible product concentration

-

The review and execution mechanism

Investment approach

Once the investment policy is clear, we work out the appropriate portfolio based on the investment objective and horizon. This involves:

Selecting the right asset class

From multiple money market funds, sovereign bonds, AAA securities, ETF, liquid and ultra short funds, as also other asset classes based on the risk preference.

Creating the bucketed approach

Based on the investment horizon and goals, we focus on a 3-bucket approach for fixed income investments. This approach looks at creating a judicious blend of ‘cushions / insulators’ + ‘flexible strategies’ + ‘yield enhancers’ which may be required to navigate volatile markets. This ‘3-bucket’ approach includes:

As an illustration, these could include ideas that avoid near-term mark to market impact such as debt-oriented or long-short AIFs, market-linked debentures and rate reset-ideas.

This bucket may offer tranche entries into medium to long term, Government of India Securities/ State Development Loan roll-down strategies – essentially a prudent mix of high-quality accrual with reducing duration risk instruments.

This bucket refers to those ‘yield boosters’ such as Marked-linked debentures, Alternate Investment Funds and other strategies.

Constant monitoring and reporting

We constantly monitor the investment to ensure that the risk is within controllable limits. A dedicated platform enables reporting of the investment and a consolidated view.

One size doesn’t fit all

We offer a range of personalised wealth solutions for clients from diverse backgrounds such as entrepreneurs, company founders, CXOs, professionals such as doctors, lawyers and CAs, in addition to family offices and company treasuries.

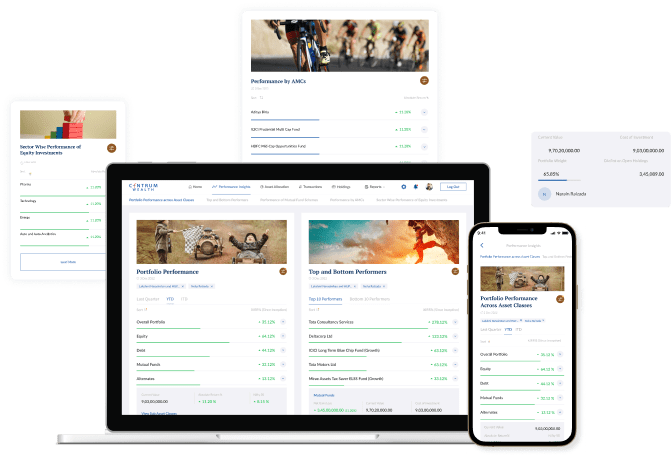

A platform for performance insights

Information overload often clouds the decision-making process. The Centrum Wealth Wealthverse platform brings you anytime access to your portfolio and enables analysing holdings in your way.

Know More

Leadership Perspectives

-

Business

Market Insights

Manish Jain shares his perspective on market conditions, economic factors, and potential opportunities in June 2025. Gain from an informed view of what lies ahead and how to navigate market conditions to keep your investment strategies aligned.

Know More -

Business

Market Insights

Shankar Raman shares his perspective on market conditions, economic factors, and potential opportunities in May 2025. Gain from an informed view of what lies ahead and how to navigate market conditions to keep your investment strategies aligned.

Know More -

Business

Market Insights

Manish Jain shares his perspective on market conditions, economic factors, and potential opportunities in March 2025. Gain from an informed view of what lies ahead and how to navigate market conditions to keep your investment strategies aligned.

Know More