How we engage

The advisory services platform is a fee-based and unbiased engagement platform that offers true alignment of interests. As part of advisory services, we guide you on your overall portfolio while the execution choice is up to you.

The combination of ‘unbiased’ and ‘alignment’ qualities is intrinsically built into the proposition because of the manner in which the engagement model is structured.

Portfolio-led

The advisory services mandate is right for those who are looking for a ‘portfolio approach’ rather than ‘product-led’ engagement. The approach involves:

Any investment advice is based on your circumstances including your objectives and risk appetite, thus ensuring that the suggested investments are in line with your risk-return profile.

You have the option of choosing the distribution platform for placing orders and investments can also happen in direct plans of products (where available).

You can choose between an AuA (Assets under Advice)-based fee or a fixed fee model.

One size doesn’t fit all

We offer a range of personalised wealth solutions for clients from diverse backgrounds such as entrepreneurs, company founders, CXOs, professionals such as doctors, lawyers and CAs, in addition to family offices and company treasuries.

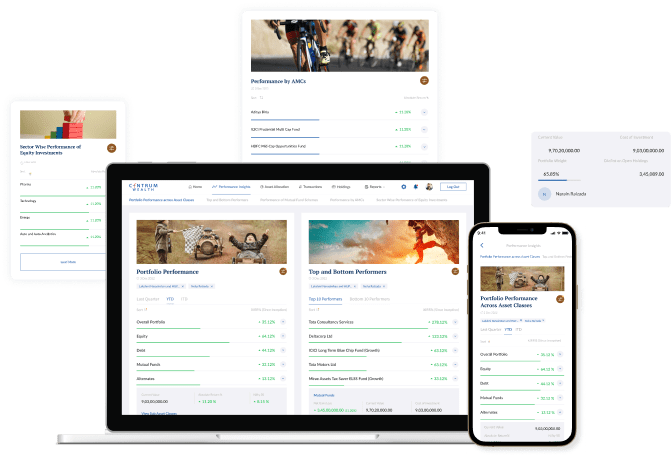

A platform for performance insights

Information overload often clouds the decision-making process. The Centrum Wealth Wealthverse platform brings you anytime access to your portfolio and enables analysing holdings in your way.

Know More

Leadership Perspectives

-

Business

Market Insights

Manish Jain shares his perspective on market conditions, economic factors, and potential opportunities in March 2026. Gain from an informed view of what lies ahead and how to navigate market conditions to keep your investment strategies aligned.

Know More -

Business

Thinking Outside In: Part 2

Priya Kumar, Author, Motivational Speaker, and Screenwriter, reflects on the hidden mindset gaps between where organisations believe they are — and where they truly stand. We also feature a perspective that explores a deeper layer of leadership and storytelling: What she looks for beyond public achievements when writing someone’s story The common inner struggles leaders […]

Know More -

Business

Thinking Outside In: Bonus Insights

Priya Kumar, Author, Motivational Speaker, and Screenwriter, reflects on the experiences that shaped her work across 17 published books. We feature a bonus question that brings out a more personal dimension of her authorial journey: Her three most significant memories from authoring 17 books The lessons that stayed with her beyond publication. Watch Now!

Know More