Wealth solutions in all flavours

Based on your profile, goals and priorities, we strive to curate a solution from a range of investment ideas spanning multiple asset classes that can fulfil your varied investment needs. These encompass:

We offer equity-based investment products such as:

- Direct Equities

- Mutual Funds

- Portfolio Management Services that include both discretionary and non-discretionary

- Derivatives

- Alternate Investment Funds

- Structured products

- Global Investments (via a dedicated platform)

We offer a choice of:

- Primary and secondary market Fixed Income instruments

- Mutual Funds

- Debt-based Alternate Investment Funds

- Debt-based Portfolio Management Services

- Tax free paper, NCDs, Corporate bonds

- Debt-oriented Structured Products

- Money market instruments in form of commercial papers (CPs) and certificate of deposit (CDs)

We provide opportunities to invest in niche private investment ideas via:

- Private Equity and Venture Capital Funds

- Unlisted Equities

- Bespoke Ideas – Know More

- Long-short strategies

We offer a host of insurance solutions encompassing:

- Life insurance

- General insurance

- Global Health insurance

Know More about our insurance offering.

In addition to investments, we also have presence on the assets side and offer credit solutions in the form of:

- Debt structuring

- Debentures

Providing 360-degree Risk Management

Our ‘#WeForYou’ group level philosophy filters through into each of our services. This becomes more relevant when dealing with long-term solutions such as insurance. Thus, identifying and delivering customer specific solutions, continuous monitoring of a client’s insurance portfolio and ongoing assistance and support form an integral part of our service proposition.

As we are licensed by the Insurance Regulatory and Development Authority of India, we have specialist personnel for insurance and risk management. We act on your behalf and provide solutions that are in your interest combined with superior service.

We look at providing 360-degree risk management solutions at both family and individual levels.

In order to achieve this objective, our offer encompasses:

- Comprehensive assessment of your existing coverage and policies.

- Suggestions toward creation of a comprehensive insurance solution based on the assessment.

- Multiple choices from the across the insurance universe which is appropriate and custom made.

-

Global health insurance

-

Term insurance

-

Succession planning solutions

-

Insurance with tax free return ideas

-

Employer-employee solutions

-

Art and fine jewelry protection

Service differentiators

Our insurance solution is a ‘one of its kind’ initiative to help you understand your existing Insurance portfolios in a simplified manner providing a complete picture in terms of coverage and cash flows.

Our key differentiators include:

-

Unbiased advisory services

We act as an unbiased insurance broker and represent your interest while scanning the market place for probable solutions.

-

Dedicated insurance team

A dedicated and qualified team of insurance specialists help you with comprehensive Insurance solutions.

-

Claims support desk

Technology can’t replace the human touch. Hence a dedicated claim support desk with seasoned team members is available to provide 360-degree support.

Selecting from the best

Centrum Wealth is associated with multiple insurance companies spanning life, health, term plans, income plans, cash flow or maturity plans as well as travel insurance and motor insurance.

Indicative Bespoke Ideas For You

For bespoke ideas, we have an exclusive desk that focusses on boutique or ‘off the conventional shelf’ ideas. The team has its ears firmly to the ground and is supported by an effective financial services network. This highly specialised service seeks to add value to the portfolio because of relevance, scarcity or simply by ‘being at the right place at the right time’.

Illustrative segments where ideas have been successfully executed:

-

Unlisted / pre-IPO opportunities

-

Structured / customized debt transactions

-

Venture investing (direct/jointly with funds)

-

Distressed asset investments

Structured credit overview

The structured credit desk seeks to capture a part of the private credit opportunity in India. The need for private credits is accentuated by recent market disruptions leading to reduced credit from banks, non-bank lenders and asset management companies while the growth in macro economy and trade has resulted in strong credit demand from Indian corporates.

Our structured credit team is ideally positioned to capitalize on this opportunity by deploying flexible capital in the form of debt, mezzanine or hybrid instruments in the mid-market segment. The investment approach seeks performing credits only, with a sector focused approach toward businesses with good ROE and free cash flow. Further, promoters track record, experienced management and cash flow backed well-collateralized credits are a few of the factors considered while investing by the team.

Offshore solutions overview

If your investment outlook spans the global economy and covers developed as well as emerging global markets, then we have the services and capabilities which are well positioned to be of assistance. Through our global office, you get access to a customized array of offshore investment opportunities. Our team of domain experts located in Singapore perform due diligence, product level evaluation and structuring activities.

One size doesn’t fit all

We offer a range of personalised wealth solutions for clients from diverse backgrounds such as entrepreneurs, company founders, CXOs, professionals such as doctors, lawyers and CAs, in addition to family offices and company treasuries.

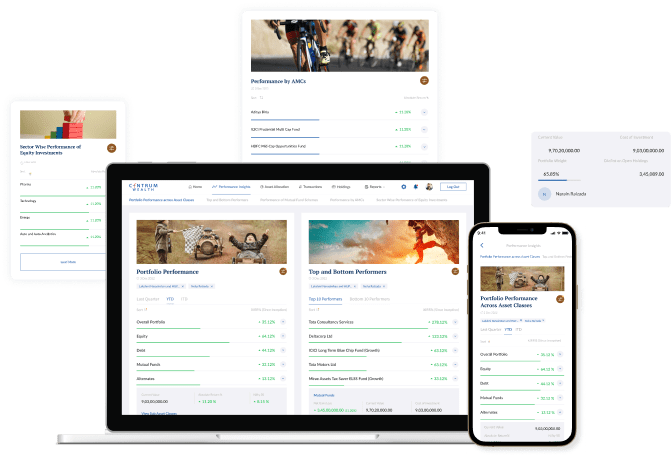

A platform for performance insights

Information overload often clouds the decision-making process. The Centrum Wealth Wealthverse platform brings you anytime access to your portfolio and enables analysing holdings in your way.

Know More

Leadership Perspectives

-

Business

Thinking Outside In: Part 2

Priya Kumar, Author, Motivational Speaker, and Screenwriter, reflects on the hidden mindset gaps between where organisations believe they are — and where they truly stand. We also feature a perspective that explores a deeper layer of leadership and storytelling: What she looks for beyond public achievements when writing someone’s story The common inner struggles leaders […]

Know More -

Business

Thinking Outside In: Bonus Insights

Priya Kumar, Author, Motivational Speaker, and Screenwriter, reflects on the experiences that shaped her work across 17 published books. We feature a bonus question that brings out a more personal dimension of her authorial journey: Her three most significant memories from authoring 17 books The lessons that stayed with her beyond publication. Watch Now!

Know More -

Business

Thinking Outside In: Sandeep Das in conversation with Priya Kumar, Author and Motivational Speaker

Priya Kumar, Author, Motivational Speaker and Screen Writer, has spent 30 years answering that question—across 51 countries and 2,000+ corporates. In this episode of Thinking Outside In with Sandeep Das, MD & CEO, Centrum Wealth : Reading audiences in the first 60 seconds Creating markets from scratch Why boards keep getting culture wrong Watch Now!

Know More