Invest as you Prefer

With our in-house Asset Management offering, you can utilise our domain expertise to get equity advise or invest in our portfolio management offering.

Our offerings include:

Equity Advisory

How we engage

The advisory services platform is a fee-based and unbiased engagement platform that offers true alignment of interests. As part of advisory services, we guide you on your overall portfolio while the execution choice is up to you.

The combination of ‘unbiased’ and ‘alignment’ qualities is intrinsically built into the proposition because of the manner in which the engagement model is structured.

-

Client-first

-

Driven by expertise

-

Proactive approach

-

Communicative

-

Wide coverage

-

Review and reporting

Focus on streamlined returns, optimised cost

We work with corporate treasury teams across sectors which are at different stages of growth: right from start-ups to listed companies to financial institutions.

-

Sector and market-cap agnostic

We prefer segments that offer monopolistic, duopolistic or at best oligopolistic businesses with pricing power. Or at best a space where only a few companies with high market share operate and are consistent performers within the space.

-

Investment horizon

We look at a minimum of a 3 to 5 years plus investment in the form of a dedicated long-term holding.

-

Buy & Hold strategy

Accumulating fundamentally strong quality businesses, at reasonable valuations in a staggered manner. The vision is to stay invested till the investment thesis holds good.

-

Investment Discipline

- Core focus on wealth creation, preservation and possible multiplication via long only investing in great businesses.

- Portfolio recommendations backed by fundamental research.

- Investment management and monitoring by an expert team.

- Buy and Hold. Liquidation only if the expected potential is achieved or there are changes to the investment thesis or corporate governance issues/other red flags.

- Disciplined approach with sector and stock weightage.

- Frequent churning/trading is a complete “NO”.

The approach for shortlisting stocks

In identifying the right stock, we look at multiple framework and parameters:

-

The 3S Investment Framework

We look at:

- Size of the Market Opportunity (Segment/Overall Pie becoming larger)

- Share of the Industry / Opportunity (Within the segment growth)

- Margin of Safety / Valuations (Prudent Risk Management)

-

Approach for new or emerging businesses

For new age businesses without long listing history, we look at factors such as:

- Business history prior to listing

- Management pedigree and fundamentals.

- Growth visibility and valuations

- Valuation re-rating companies

-

Qualitative and quantitative measurement

We look at both qualitative and quantitative measures that include:

Qualitative measures:- Strong management pedigree and good corporate governance.

- Market leaders, high market share businesses across the spectrum of market cap.

- Business model should have USP or a moat or some kind of competitive advantage, pricing power.

Quantitative measures:

- Consistent business growth 3/5/10 Years.

- Healthy and consistent profitability margins.

- Considering appropriate valuation parameters.

Portfolio Management

Portfolio Management Services

You can benefit with the expertise provided through our in-house portfolio management capabilities. We offer both discretionary and non-discretionary services with the flexibility of having other asset classes and mutual funds as part of the portfolio, in addition to direct equities.

Discretionary Portfolio Management

A high calibre in-house discretionary portfolio management service offering that speedily reacts to emerging opportunities in the markets. This team addresses your requirements faster due to a good understanding of your needs and risk profile.

Having an in-house team also offers flexibility to swiftly create products when the need arises. External validation of the robust process and performance has been witnessed, with the team having received recognitions from global as well as local industry watchers.

Non-Discretionary Portfolio Management

The non-discretionary portfolio management brings together Centrum Wealth’s expertise and a process driven approach to address your specific needs with model portfolios that are further customised as per your requirements and directions.

The fund team discusses portfolio directives and recommended products with you and final investment execution is driven solely with your consent.

The Centrum AIM non-discretionary portfolio management service provides risk profile-based portfolio segmentation and customised portfolios which can be categorised as aggressive, balanced and conservative.

Proprietary framework for stock selection

Centrum Wealth portfolio management uses a proprietary framework for stock selection which is our EDGE.

- Execution (company track record, management history)

- Deep dive research (Size of opportunity, competitive advantage and channel checks)

- Governance (Accounting quality, capital allocation, Dividend policy)

- Earnings quality (EBITDA and ROCE factors, cash flow and leverage)

One size doesn’t fit all

We offer a range of personalised wealth solutions for clients from diverse backgrounds such as entrepreneurs, company founders, CXOs, professionals such as doctors, lawyers and CAs, in addition to family offices and company treasuries.

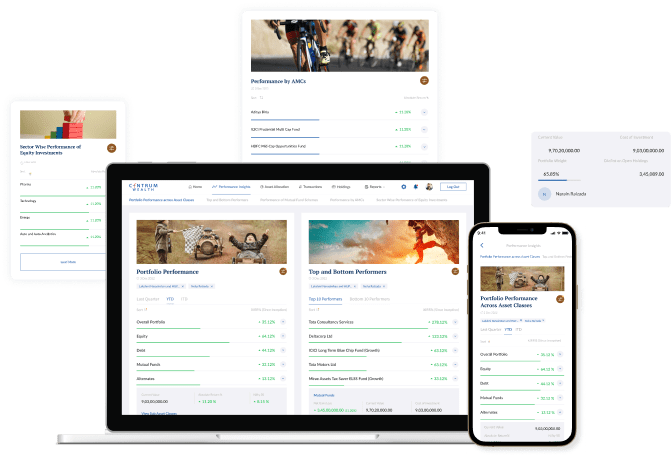

A platform for performance insights

Information overload often clouds the decision-making process. The Centrum Wealth Wealthverse platform brings you anytime access to your portfolio and enables analysing holdings in your way.

Know More

Leadership Perspectives

-

Business

Thinking Outside In: Part 2

Priya Kumar, Author, Motivational Speaker, and Screenwriter, reflects on the hidden mindset gaps between where organisations believe they are — and where they truly stand. We also feature a perspective that explores a deeper layer of leadership and storytelling: What she looks for beyond public achievements when writing someone’s story The common inner struggles leaders […]

Know More -

Business

Thinking Outside In: Bonus Insights

Priya Kumar, Author, Motivational Speaker, and Screenwriter, reflects on the experiences that shaped her work across 17 published books. We feature a bonus question that brings out a more personal dimension of her authorial journey: Her three most significant memories from authoring 17 books The lessons that stayed with her beyond publication. Watch Now!

Know More -

Business

Thinking Outside In: Sandeep Das in conversation with Priya Kumar, Author and Motivational Speaker

Priya Kumar, Author, Motivational Speaker and Screen Writer, has spent 30 years answering that question—across 51 countries and 2,000+ corporates. In this episode of Thinking Outside In with Sandeep Das, MD & CEO, Centrum Wealth : Reading audiences in the first 60 seconds Creating markets from scratch Why boards keep getting culture wrong Watch Now!

Know More