Catering to more than just your investments

We have an ‘all encompassing’ proposition for wealth-related needs that combines holistic investment management, wealth planning & structuring, and family business advisory and offshore solutions.

Residential/taxation status of various beneficiaries is critical as there would be differences in reporting requirements and tax implications under different jurisdictions.

The choice of investing entities, especially in using a company, also has implications such as dividend tax, minimum alternate tax, buyback tax on companies, and tax on dividend received by shareholders. Other implications include deemed NBFC classification and RBI-related compliance.

As part of our tax planning/structuring services we help in:

- Compliance with IT provisions

- Advising on advance tax

- Global tax filing

Our estate planning solutions seek to achieve:

- Protection and preservation of assets for future generation

- Protection and preservation of family bonds by eliminating internal disputes

- Savings costs by efficiently planning taxes and other expenses

Without proper estate planning, properties can be locked up for months or years on end as court intervention may be required to distribute the assets as per the relevant community law (Hindu Succession Act; Indian Succession Act; Muslim Law, etc).

Our Estate Planning services include:

- Assistance in obtaining Succession Certificate

- Assistance in obtaining Letter of Administration

- Nomination/Joint holding hygiene check

- Assistance in valuation of movable/immovable assets

As part of succession planning, we help establish the family business governance, which is a transparent balance of interests among:

- The owners of the family business (trusts and individuals)

- Those who manage the business (the professionals)

- The family who’s interest they serve

For our Family Business Advisory clients, we seek to ensure a seamless functioning of the core wealth creation engine, the core business of the family, by building a professional management layer, and attempting to resolve inter-generational and other potential conflicts.

Our Family Business Advisory includes:

- Business continuity

- Strategic planning

- Assigning Roles and responsibilities

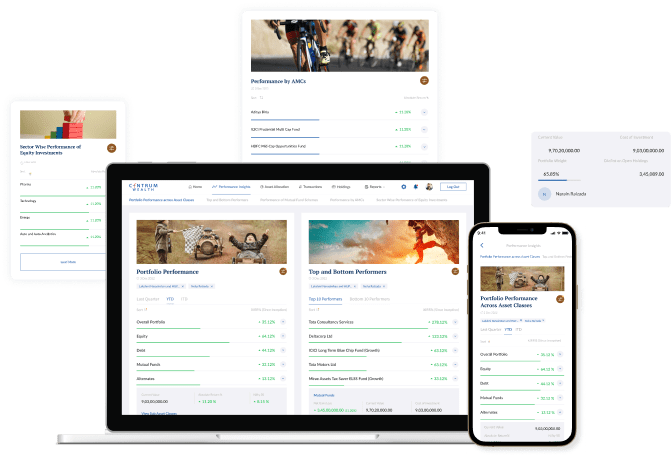

Our Portfolio Consolidation services help you get the true picture of your overall wealth clearly showcasing if the portfolios fit within the ‘big picture’ of the family’s long-term financial objectives. It makes it easier to evaluate performance of various wealth managers against common benchmark and helps you be on top of your portfolio at all times.

Our Approach to Investment

-

Investment policy

-

‘GIVLS’ framework for markets and macro assessment

-

Product selection rigour

-

Focus on portfolio outcomes

-

Strategic asset allocation

-

Tactical asset allocation

One size doesn’t fit all

We offer a range of personalised wealth solutions for clients from diverse backgrounds such as entrepreneurs, company founders, CXOs, professionals such as doctors, lawyers and CAs, in addition to family offices and company treasuries.

A platform for performance insights

Information overload often clouds the decision-making process. The Centrum Wealth Wealthverse platform brings you anytime access to your portfolio and enables analysing holdings in your way.

Know More

Leadership Perspectives

-

Business

Thinking Outside In: Part 2

Priya Kumar, Author, Motivational Speaker, and Screenwriter, reflects on the hidden mindset gaps between where organisations believe they are — and where they truly stand. We also feature a perspective that explores a deeper layer of leadership and storytelling: What she looks for beyond public achievements when writing someone’s story The common inner struggles leaders […]

Know More -

Business

Thinking Outside In: Bonus Insights

Priya Kumar, Author, Motivational Speaker, and Screenwriter, reflects on the experiences that shaped her work across 17 published books. We feature a bonus question that brings out a more personal dimension of her authorial journey: Her three most significant memories from authoring 17 books The lessons that stayed with her beyond publication. Watch Now!

Know More -

Business

Thinking Outside In: Sandeep Das in conversation with Priya Kumar, Author and Motivational Speaker

Priya Kumar, Author, Motivational Speaker and Screen Writer, has spent 30 years answering that question—across 51 countries and 2,000+ corporates. In this episode of Thinking Outside In with Sandeep Das, MD & CEO, Centrum Wealth : Reading audiences in the first 60 seconds Creating markets from scratch Why boards keep getting culture wrong Watch Now!

Know More