Investment policy statement

The investment policy statement communicates the investment goals & serves as a guidepost for ongoing management of the portfolio. It creates the necessary guard rails so that risk limits are not busted in ‘good times’.

-

The investment horizon

-

The investment objective

-

The portfolio liquidity required

-

Asset allocation choices

-

The possible product concentration

-

The review and execution mechanism

Investment approach

Once the investment policy is clear, we work out the appropriate portfolio based on the investment objective and horizon. This involves:

Selecting the right asset class

From multiple money market funds, sovereign bonds, AAA securities, ETF, liquid and ultra short funds, as also other asset classes based on the risk preference.

Creating the bucketed approach

Based on the investment horizon and goals, we focus on a 3-bucket approach for fixed income investments. This approach looks at creating a judicious blend of ‘cushions / insulators’ + ‘flexible strategies’ + ‘yield enhancers’ which may be required to navigate volatile markets. This ‘3-bucket’ approach includes:

As an illustration, these could include ideas that avoid near-term mark to market impact such as debt-oriented or long-short AIFs, market-linked debentures and rate reset-ideas.

This bucket may offer tranche entries into medium to long term, Government of India Securities/ State Development Loan roll-down strategies – essentially a prudent mix of high-quality accrual with reducing duration risk instruments.

This bucket refers to those ‘yield boosters’ such as Marked-linked debentures, Alternate Investment Funds and other strategies.

Constant monitoring and reporting

We constantly monitor the investment to ensure that the risk is within controllable limits. A dedicated platform enables reporting of the investment and a consolidated view.

One size doesn’t fit all

We offer a range of personalised wealth solutions for clients from diverse backgrounds such as entrepreneurs, company founders, CXOs, professionals such as doctors, lawyers and CAs, in addition to family offices and company treasuries.

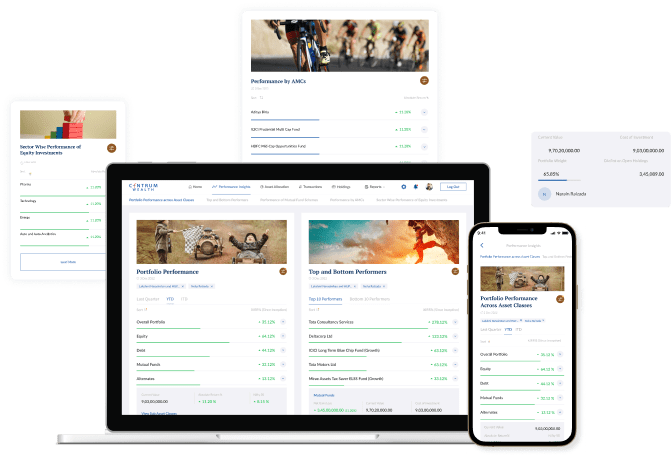

A platform for performance insights

Information overload often clouds the decision-making process. The Centrum Wealth Wealthverse platform brings you anytime access to your portfolio and enables analysing holdings in your way.

Know More

Leadership Perspectives

-

Business

Thinking Outside In: Part 2

Priya Kumar, Author, Motivational Speaker, and Screenwriter, reflects on the hidden mindset gaps between where organisations believe they are — and where they truly stand. We also feature a perspective that explores a deeper layer of leadership and storytelling: What she looks for beyond public achievements when writing someone’s story The common inner struggles leaders […]

Know More -

Business

Thinking Outside In: Bonus Insights

Priya Kumar, Author, Motivational Speaker, and Screenwriter, reflects on the experiences that shaped her work across 17 published books. We feature a bonus question that brings out a more personal dimension of her authorial journey: Her three most significant memories from authoring 17 books The lessons that stayed with her beyond publication. Watch Now!

Know More -

Business

Thinking Outside In: Sandeep Das in conversation with Priya Kumar, Author and Motivational Speaker

Priya Kumar, Author, Motivational Speaker and Screen Writer, has spent 30 years answering that question—across 51 countries and 2,000+ corporates. In this episode of Thinking Outside In with Sandeep Das, MD & CEO, Centrum Wealth : Reading audiences in the first 60 seconds Creating markets from scratch Why boards keep getting culture wrong Watch Now!

Know More